Implementation of KYC Policy

How our client minimized risks associated with potential fraud, accelerated the verification process by 20 times, and reduced the number of bad loans by 20%.

In that case, we were asked to implement a KYC policy for one of our key customers. It was an international commercial bank, a leader in service quality in the Ukrainian banking sector.

Business Task

Know Your Customer (KYC) is a process of identifying and verifying a customer's identity, which helps to avoid commercial risks in relations with counterparties.

This project included a number of tasks, such as:

- regulatory compliance

- internal regulations

- risk management

- anti-money laundering (AML)

Challenges along the path

There were a few hindrances we faced when we started the project:

- lack of a constantly updated and high-quality monitoring system that provides timely information

- reputational risks associated with cooperation with fraudsters due to not receiving updated information on counterparties

- a lot of time and resources were spent manually checking customers, employees, and partners

- the bank's financial losses — bad loans — were the result of poor fraud detection at the verification stage

- lack of prompt response to the negative changes in the customer's history

- employees from different bank divisions conducted uncontrolled checks in a paid resource, which led to spontaneous costs for such operations

Solution

Our team has created a single database that is updated in a timely manner. It contains all the information about the target audience the Bank is interested in. Moreover, we have successfully implemented Camunda, which became the orchestrator of all banking processes. Using the DMN engine, we implemented a scoring and decision-making system. We have also developed a user-friendly interface that can be customized according to the needs of each department involved in the checks.

Results

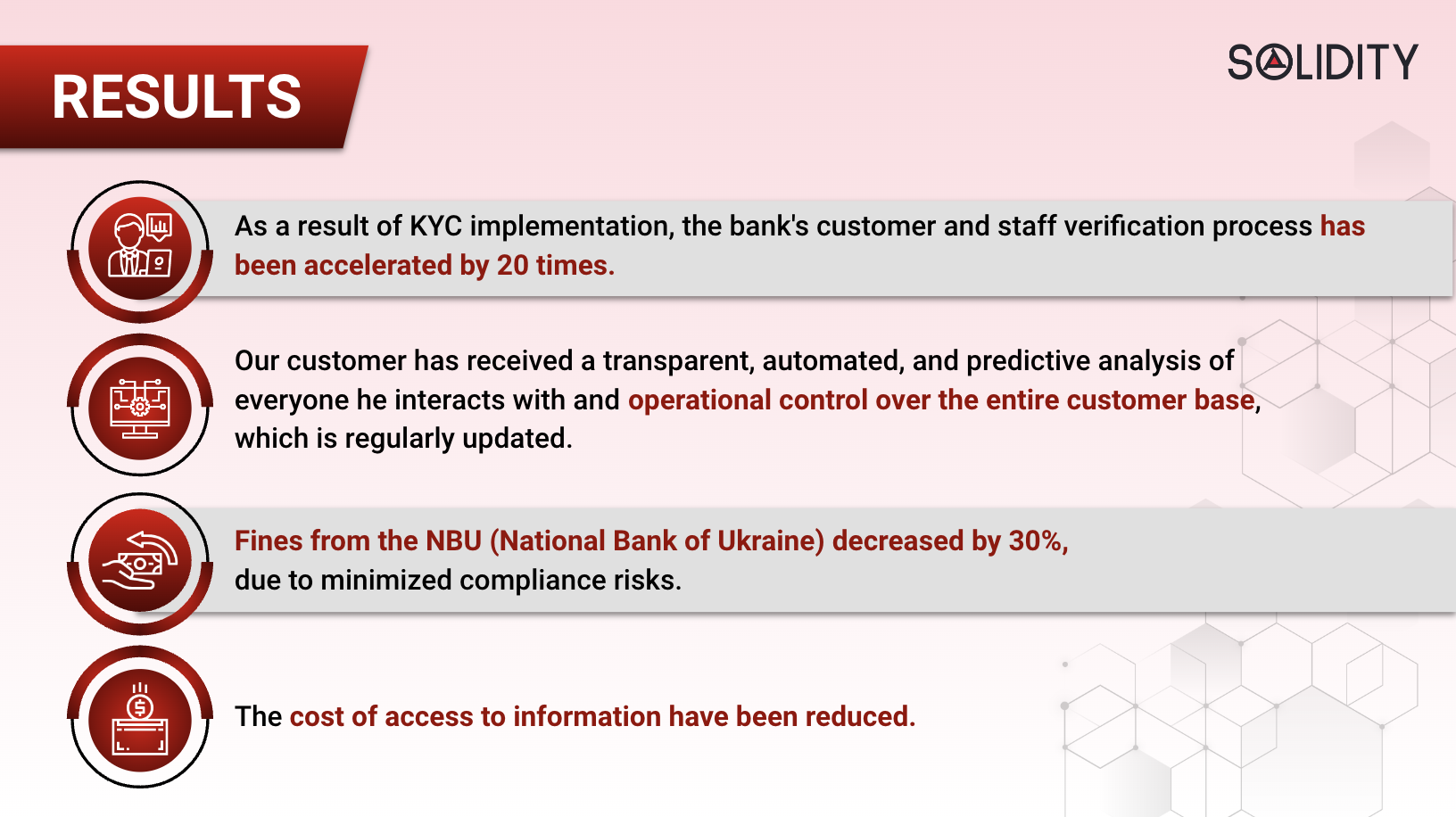

As a result of KYC implementation:

- the bank's customer and staff verification process has been accelerated by 20 times

- the cost of access to information has been reduced

- the number of bad loans decreased by 20%

- fines from the NBU (National Bank of Ukraine) decreased by 30 % due to minimized compliance risks

- the number of employees involved in the verification process has been reduced due to automation

Our customer has received a transparent, automated, and predictive analysis of everyone he interacts with and operational control over the entire customer base, which is regularly updated. We helped the bank successfully minimize the risks associated with potential fraud activity.