Banking for Safer Payments

How the commercial bank reduced reputational risks by 90% and the level of fraud by 70% in 5 months.

Several years ago, we got a request from the international commercial bank listed in the Top 10 largest banks in Ukraine. The bank has approximately 100 branches throughout Ukraine and services 520,000+ retail customers and 53,000 legal entities.

Business Task

The customer decided to create a new online banking platform (web and mobile versions) for private and legal accounts, which functionality would be increased by 4 times. During the planning stage, the issue of implementing a fraud prevention system arose. This project was expected to serve almost 1 million users. Our team was tasked with synchronizing the launch of the anti-fraud system with the opening of a new online banking platform.

Challenges along the path

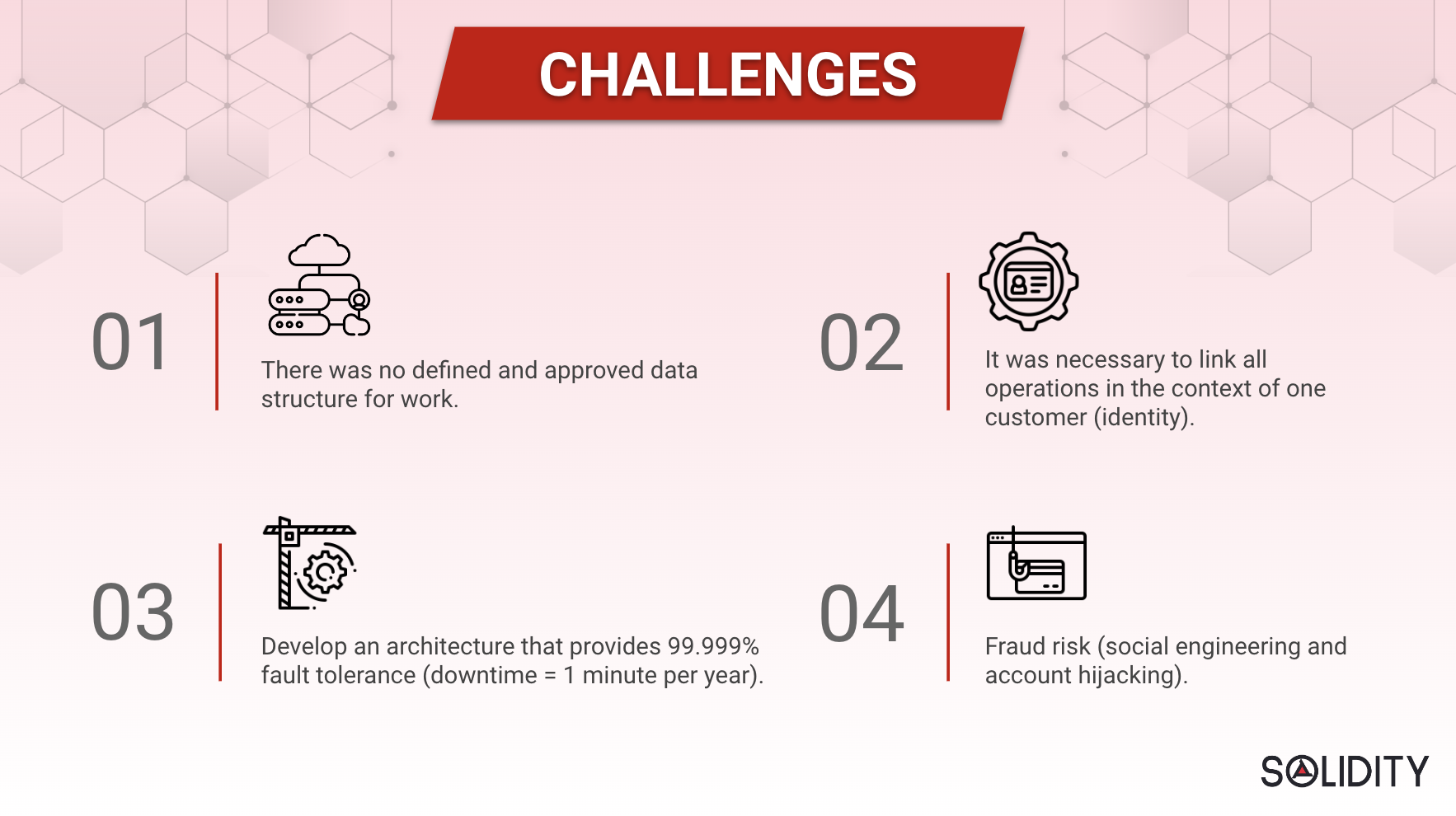

There were several challenges the bank has faced at the very beginning:

- there was no defined and approved data structure for the work

- it was necessary to link all operations in the context of one customer (identity)

- another need: to develop an architecture that provides 99.999% fault tolerance (downtime = 1 minute per year)

- fraud risk (social engineering and account hijacking)

Solution

Our team has created the architecture which provides that if one of the platforms (data centers) is unavailable, the service continues to work without delays. So, the architecture ensures uninterrupted service operation. Moreover, the service does not stop even during regular updates (no downtime). We have also implemented separate practical training for administrators and analysts of the bank.

Results

As a result, our team of 5 specialists has implemented the project in 5 months. We helped the customer:

- develop and implement a data structure that allowed the bank to combine customer profiles in different roles (individual entrepreneurs, sole proprietors, legal entities)

- reduce the level of fraud by 70%

- reduce reputational risks by 90%

- decrease the speed of applying countermeasures to new fraud from 5 days to 5 minutes

After the implementation of the anti-fraud system, the bank requested the development of a control system for a new channel — international payments. We have successfully implemented the project in 2 weeks. To this day, the system has been operating flawlessly for 2.5 years without any interruptions.