IBM Safer Payments: cost saving and benefits for business

The evolution of financial instruments and the emergence of new payment channels opened new ways for criminals to fraud. At the same time, it developed a market to prevent fraud.

IBM Safer Payments anti-fraud solution is a tool that uses artificial intelligence capabilities to detect fraud and offer new or improve existing solutions, test them, and implement new models in minutes.

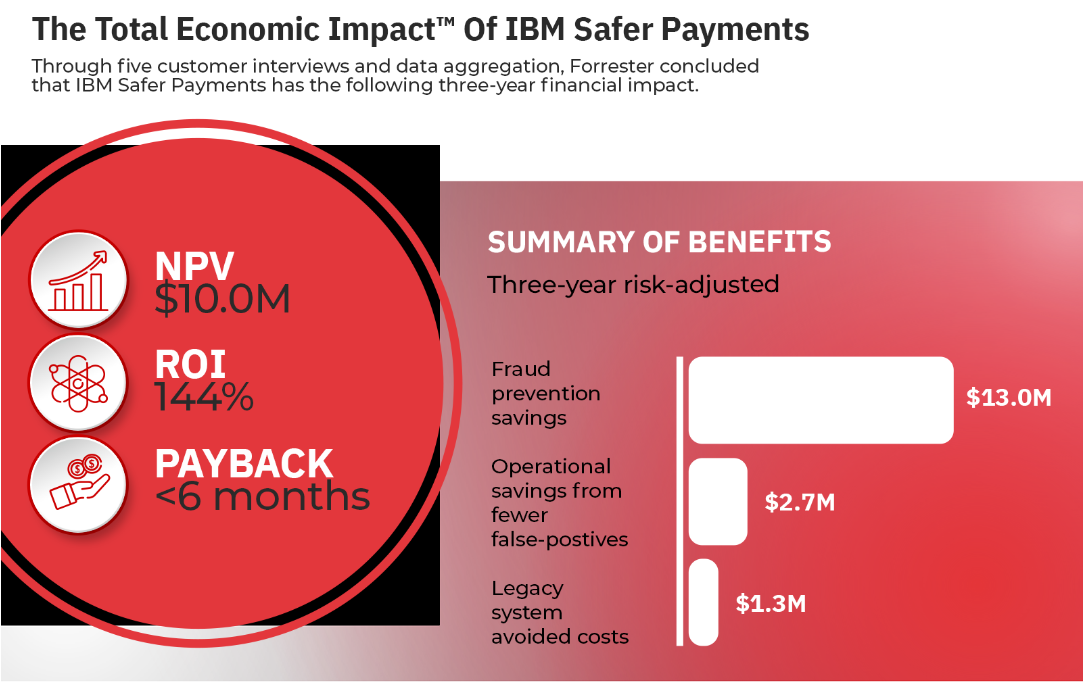

Forrester Consulting researched what are the business benefits of IBM Safer Payments and why it’s economically profitable. To help customers better understand the benefits and risks of this investment, Forrester interviewed five customers who have experience using IBM Safer Payments. This helped to identify the key benefits of this solution and helped to estimate the costs of implementation. We share the results of this survey.

Key research results

Source: A Forrester Total Economic Impact Study commissioned by IBM

Quantified benefits for companies

1. IBM Safer Payments helps better detect fraud and reduce customer losses. In the bank, where the total number of transactions per year was 800 million - the losses from fraud, which were avoided in three years, amounted to more than 13 million dollars.

These results, Forrester analysts explain, may not reflect the whole experience. Savings can differ depending on many factors in a company – payment channels, transaction volumes, region, existing system, optimization of fraud rules and models. To account for these risks, Forrester adjusted this benefit downward by 10%.

2. In a legacy environment, customers could not quickly adapt their risk assessment models or write new rules to adapt to new methods of fraud. Especially in channels such as digital payments.

According to the study, thanks to IBM Safer Payments the number of transactions selected for verification may probably be reduced by 70%, 73% and 77%, in accordance by 1, 2 and 3 years after implementation.

Improved model accuracy reduces false-positive rates by up to 77% and improves analyst productivity. IBM Safer Payments models improve accuracy based on transactional data, navigational data and analyst decisions, culminating in lower false-positive rates and providing analysts with the information necessary to evaluate transactions more efficiently. Over three years and a cumulative total of nearly 90,000 avoided analyst review hours, the improvements are worth more than $2.7 million to the organization.

3. The legacy rules-based systems are high-maintenance, requiring costly tuning and annual updates. Over three years, the organization saves $1.3 million by avoiding upgrades and licensing costs.

Thanks to IBM SP, the surveyed companies achieved savings in several categories:

- Reduced investment costs in auxiliary technologies, software updating and additional equipment purchases to support existing solutions.

- Most vendors include limited functionality in the base license. Additional features must be purchased separately, which limits the сustomer in effectively combating fraud and creating new models for this.

- Legacy systems required additional resources. Customers had to invest in fraud analysts, data analysts and programmers to support such a system. Thanks to IBM Safer Payments, they were able to avoid hiring 5 to 15 employees.

- Unquantified benefits

- Savings through reliance on business units rather than outside vendors or consultants.

- The ability to increase the frequency and speed of model changes.

- Improved employee experience with user-friendly UI that makes necessary information available in one location.

- Extended solution effectiveness due to evolution with an open environment, resulting in a longer-term investment.

According to the study, the net present value (NPV) is $ 10 million and the return on investment is 144%.

Why IBM?

- IBM Safer Payments is a modern open data science platform that can consume externally developed models. Unlike legacy solutions that use statistical modelling of big data sets, IBM SP uses built-in artificial intelligence, which allows the tool to be relevant.

- IBM is a technology company with specialists in dozens of countries around the world. So customers have no problem accessing specialist support.

- Simple user interface and clear models allow you to control this tool yourself.

- The corporate tool provides multi-channel operation and scales quickly for real-time payment processing. IBM Safer Payments studies the behavior of payment channels, including credit cards, ATMs, online banking, and newer digital payment channels.

Yuriy Fedets, Director of Solidity: “Our specialists have been working in the field of financial security for more than 10 years. They have extensive experience and knowledge of financial and information security solutions. Our team uses that expertise to achieve the best results in the implementation of projects for customers. One of the most popular products among our specialists is the IBM Safer Payment anti-fraud solution, which allows us to implement projects 100% effectively and on time.”

Total Economic Impact is a methodology developed by Forrester Research that improves technology decision-making processes in a company and helps vendors communicate the value offerings of their products and services to customers.